Maximize Investor value by creating a wide portfolio of real estate assets, generating strong cash flow and dividends, and ultimately, substantial capital gains as trends eventually reverse. The portfolio will be expanded both in existing locations and new locations within the U.S.A.

focus on “asset picking” by identifying and purchasing assets at a low price, off market deals - such as from banks, distressed sellers, or other properties at steep discounts, with the potential to increase yield from rent and reduced costs resulting from efficient management methodology.

Real estate property will be purchased from either by none leveraged fund resources, and through non-recourse, cash out mortgage, based on a higher value of the asset due to improvement of the property and the tenant profile.

such a strategy assists in maintaining a low risk profile.

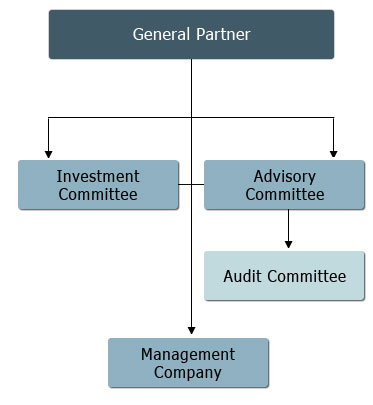

General Partner

The Committee shall oversee the strategy of the Fund.

Investment Committee

Advisory team

CEO Tzvi Itzik, CPA, MBA; CEO of NETZ.

Mr. Menachem Gurevitch:

With experience of over 15 years in real estate in Connecticut;

A thorough knowledge of the real estate market and U.S. funding.

Owner of a dominant property management company in New Haven; In everyday business relationships with official receivers, banks, brokers and lawyers, in the region. Advantage: continuous deal flow and ongoing off Market deals.